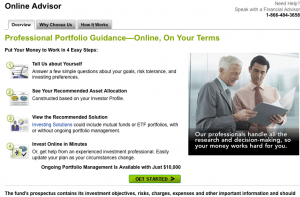

So today Etrade introduced a new online portfolio tool that will allow investors to cut out investment advisors. Supposedly it will give self-directed investors, after filling out a questionnaire, a recommended asset allocation model. According to an Etrade spokesperson this is geared towards the investor that is leaving a full service firm, still needs guidance but wants to control investing himself.

So here are my unvarnished thoughts. Oh- that will work really well as long as the markets start to recover and numbers go up. And it will work really poorly as individual investors start lining up on the ledge as markets start to tank. Perhaps one of the most valuable aspects of having a long term relationship, and I mean long term, with an RIA is the advice you get when markets start to tumble. The words “long term” have a different meaning, and it takes real discipline to keep and maintain a long term investment strategy. Yes, I suppose the last 2 quarters of 2008 have shown us that stuff happens- but keeping that long term prospective is where an outside counsel can really help.

Since when did financial advice only become about performance? Yes- some of it is about asset allocation, some of it is about risk ratios, but some of it is about listening, being sympathetic. But some of it is also about reminding investors what their long term goals are, reminding them of historical patterns, and pointing out where models continue to work, and where they don’t. Lots of it is about experience and expertise and research- commodities that the do-it-yourself-financial-advisor may not have.

And so, once again our online replacements for real advisors, will attract average investors that want to cut out any fees, and want to control all their assets themselves. But I bet that will only work in the short run. In the long run… do you really want to take your advice from a company that makes wonderful commercials but whose own stock is down a gazillion percent and who has flirted with bankruptcy? Not the kind of investment advisor that I want in my court for the long haul.